EV Loan Showdown: Traditional Banks vs. Fintech Lenders (2025)

Introduction

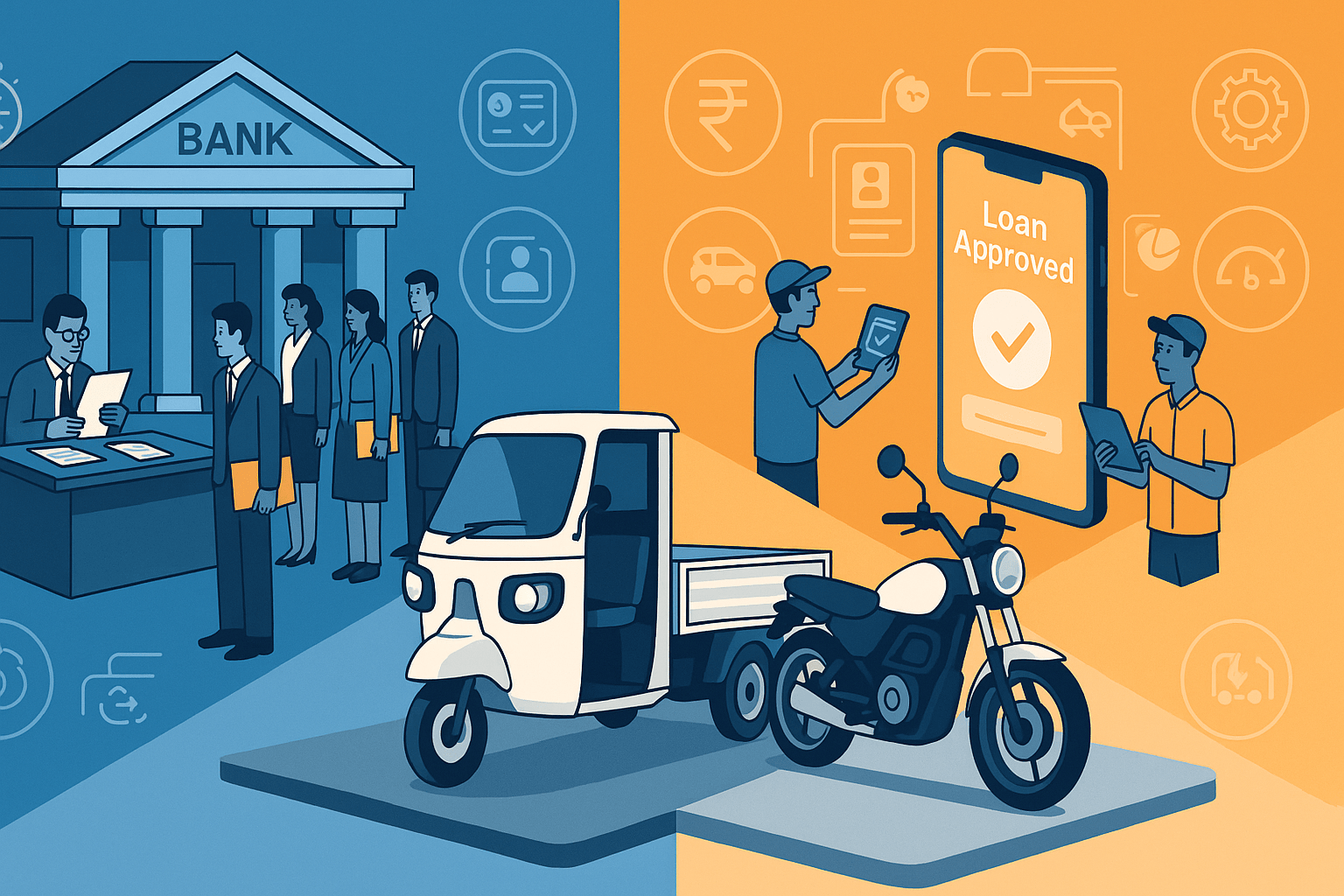

Securing a loan for your new electric vehicle in 2025 involves a strategic choice that goes far beyond simply comparing interest rates. You are choosing between two fundamentally different philosophies: the established stability of traditional banks and the specialised agility of new-age fintech lenders. This head-to-head showdown breaks down the comparison across four key factors: Speed, Eligibility, Cost, and Ecosystem Value, helping you decide which path is right for you.

1. Speed of Disbursement: The High Value of Time

-

Traditional Banks (SBI, HDFC, etc.): The loan approval and disbursal process is thorough but can be slow, typically taking between 7 and 15 days due to extensive verification and paperwork requirements.

-

Fintech Lenders (Turno, Revfin): These platforms are built for velocity. Turno promises loan disbursement within a remarkable 48 hours, while Revfin boasts an approval time of just.

16 minutes through its digital platform.

-

The Verdict: For a salaried individual, a week's delay might be a minor inconvenience. For a commercial driver, two weeks off the road is two weeks of lost income. In the commercial space, speed is not just a feature; it's a critical financial variable.

2. Eligibility & Underwriting: Who Can Get a Loan?

-

Traditional Banks: Rely heavily on conventional credit assessment. A strong CIBIL score, stable income proof, and a comprehensive document trail are essential. This model can often exclude first-time borrowers or those in the informal economy.

-

Fintech Lenders: Innovate to expand access. Revfin utilises alternative data, such as psychometrics and biometrics, to underwrite loans for individuals with no formal credit history, a game-changer for many aspiring entrepreneurs. Turno also explicitly states it can help customers secure financing even if they are unaware of their credit score.

-

The Verdict: Banks are best suited for those who are financially established. Fintechs are actively creating pathways to financial inclusion, significantly expanding the addressable market for EVs.

3. The True Cost: Rates, Down Payments, and Fees

-

Interest Rates: For prime borrowers with high credit scores, banks often offer lower headline interest rates, starting in the 8.15% to 9.20% p.a. range. Fintechs catering to higher-risk segments, like Revfin, may have rates up to 29% (annualised, reducing) to compensate for the risk, while specialised players like Turno offer competitive fixed rates around 10.5%.

-

Down Payment: This is a key differentiator. Fintechs excel at lowering the entry barrier. Turno, for example, enables customers to acquire a commercial EV with a down payment as low as ₹49,999, a fraction of what many traditional lenders might require.

-

The Verdict: While banks may offer lower rates to ideal candidates, fintechs provide greater accessibility through lower upfront costs.

4. The "X-Factor": Beyond the Loan Amount

-

Traditional Banks: Typically offer a standalone financial product. The relationship often concludes once the loan is disbursed.

-

Fintech Lenders Are increasingly building an integrated ownership ecosystem. Turno offers a Vehicle Lifecycle Management app and its revolutionary guaranteed buy-back program, which mitigates the risk associated with the asset's future value. Revfin's mission extends to empowering entrepreneurs, viewing the loan as a tool for sustainable economic growth.

-

The Verdict: Banks sell a financial product. Fintechs are selling a complete business and ownership solution.

Final Recommendation

Choose a traditional bank if you are a salaried individual with a strong credit history, can afford a higher down payment, and are willing to wait to secure the absolute lowest interest rate.

Choose a specialised fintech lender if you are a commercial operator for whom speed is critical, if you have a non-traditional credit profile, or if you value an integrated solution that de-risks the entire lifecycle of your EV asset.

For a complete overview of all current financing options, read our Ultimate Guide to EV Loans in India.